Financial Planning: Maximize Business Success with Proven Strategies and Tips

Financial planning is a crucial aspect of ensuring the success and stability of any business. Implementing effective strategies and tips can make a significant difference in navigating the complex landscape of finance. In this article, we will delve into various financial planning approaches that can help maximize business success.

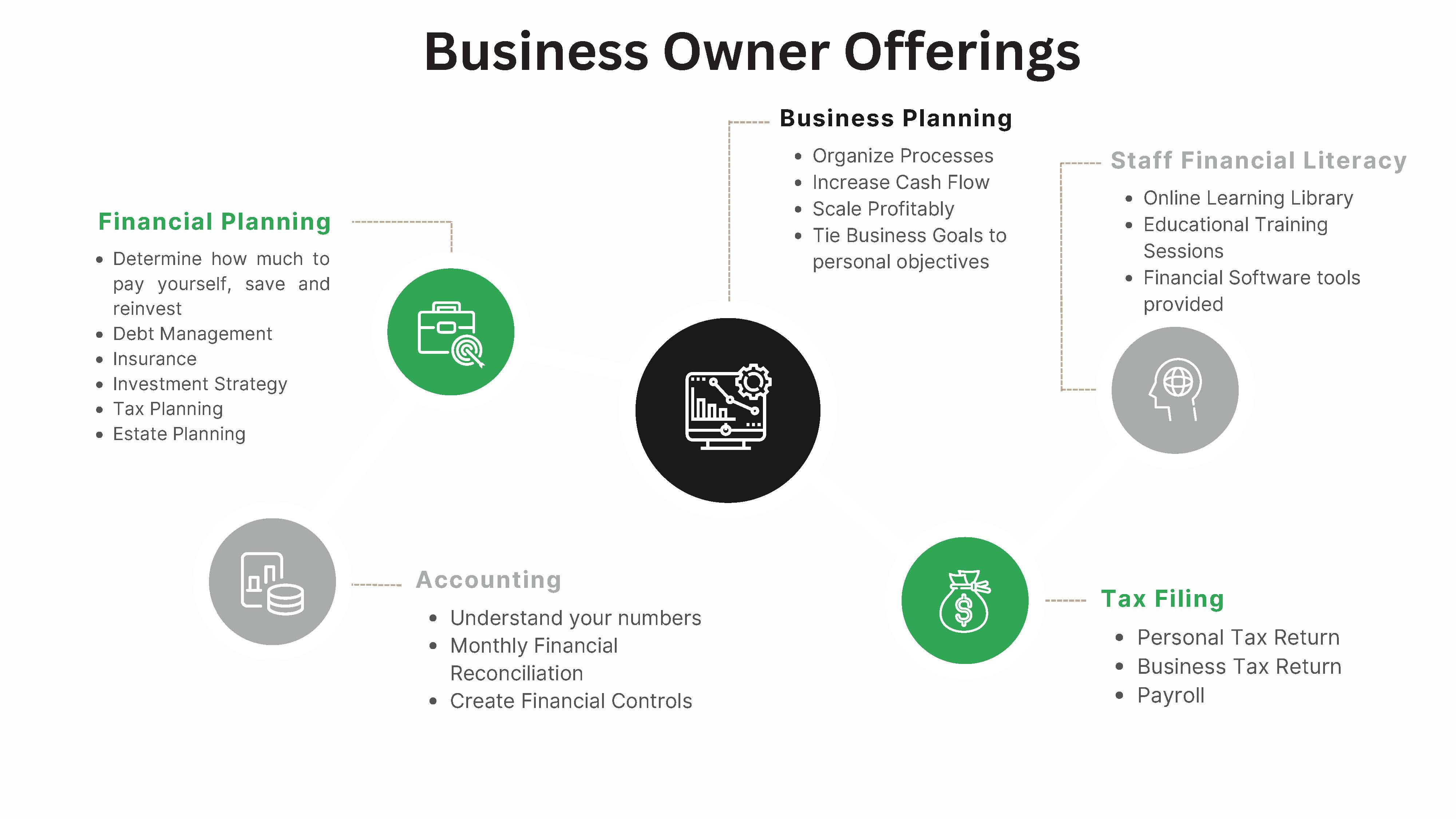

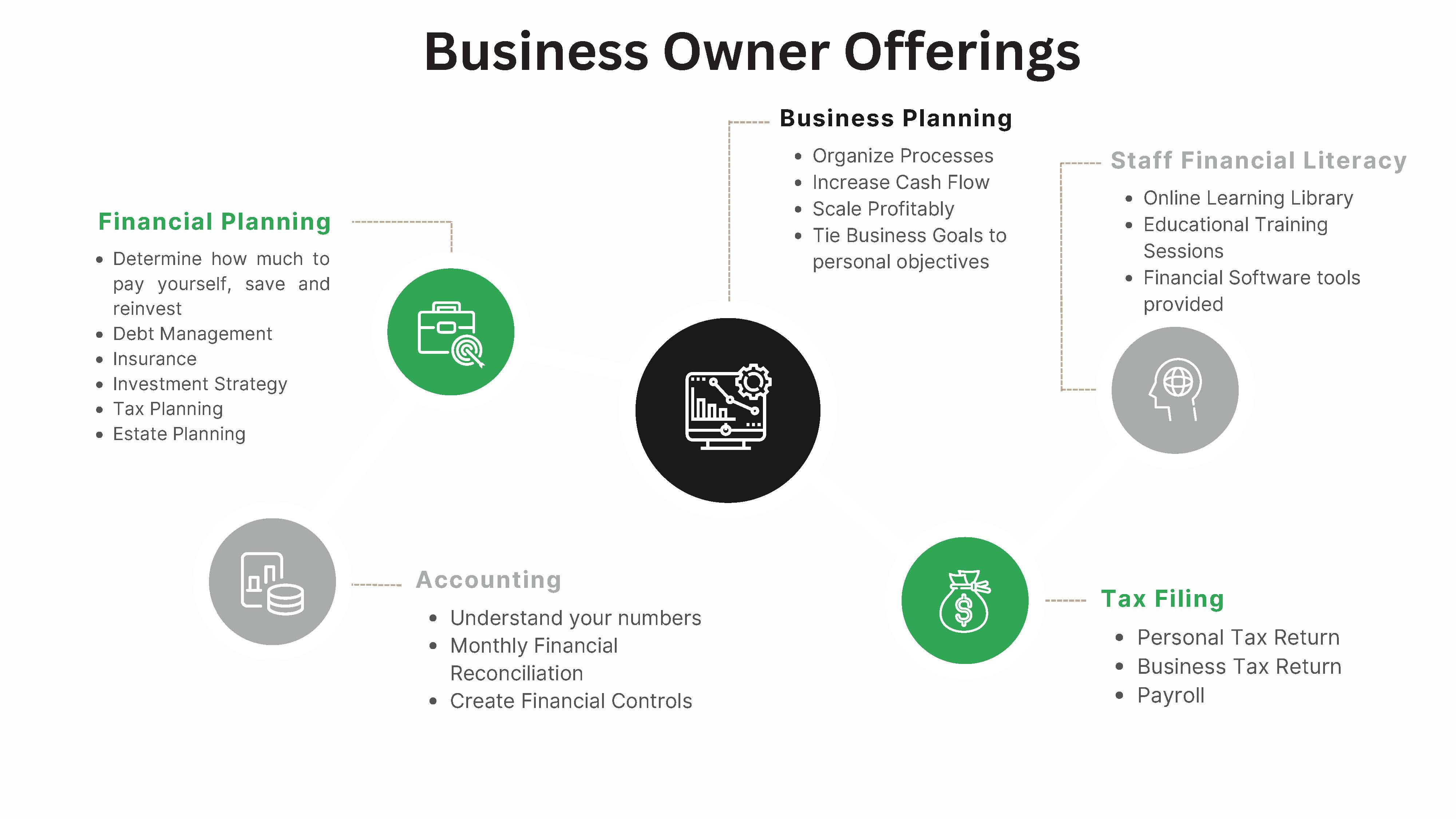

Understanding the Importance of Financial Planning

Financial planning serves as the foundation for a business’s long-term success. It involves evaluating the current financial situation, setting goals, and creating a roadmap to achieve those objectives. Without a solid financial plan, businesses may struggle to manage resources efficiently, leading to potential pitfalls in the future.

Strategic Budgeting for Sustainable Growth

One key aspect of financial planning is strategic budgeting. By allocating resources wisely, businesses can ensure sustainable growth and stability. It’s essential to identify areas where investments can yield the highest returns and allocate funds accordingly. This proactive approach helps businesses avoid unnecessary financial strain and promotes a healthy bottom line.

Risk Management: Mitigating Financial Uncertainties

No business is immune to uncertainties, but effective financial planning includes risk management strategies. Businesses need to identify potential risks, assess their impact, and implement measures to mitigate them. This might involve insurance coverage, diversification of investments, or contingency plans to navigate unexpected challenges.

Investing in Long-Term Financial Health

Smart investing is a cornerstone of sound financial planning. Businesses should explore opportunities to invest in areas that align with their long-term goals. Whether it’s expanding operations, upgrading technology, or entering new markets, strategic investments can contribute to sustained financial health.

Embracing Technology for Financial Efficiency

In today’s digital age, leveraging technology is essential for efficient financial management. Businesses can use advanced financial tools and software to streamline processes, track expenses, and generate insightful reports. Embracing technology enhances overall efficiency and provides valuable insights for making informed financial decisions.

Financial Planning Strategies Tips Business

For businesses seeking comprehensive financial planning strategies, tips, and insights, exploring Financial Planning Strategies Tips Business can be immensely beneficial. This resource offers valuable information and practical guidance to enhance your financial planning efforts.

Diversification for Financial Resilience

Diversifying revenue streams and investments is a prudent strategy to enhance financial resilience. Relying on a single source of income or investment exposes a business to greater risks. By diversifying, businesses can better withstand economic fluctuations and unexpected challenges.

Regular Financial Reviews and Adjustments

Financial planning is an ongoing process that requires regular reviews and adjustments. Business environments evolve, and so should financial plans. Conducting periodic reviews allows businesses to stay agile, adapt to changing circumstances, and make necessary adjustments to achieve their financial objectives.

Employee Financial Education Programs

Employee financial well-being is intertwined with the overall success of a business. Implementing financial education programs for employees can contribute to a more financially literate and stable workforce. This, in turn, can positively impact employee satisfaction and productivity.

In conclusion, effective financial planning is instrumental in achieving and sustaining business success. By understanding its importance, embracing strategic budgeting, managing risks, making informed investments, leveraging technology, and staying adaptable, businesses can navigate the financial landscape with confidence. Visit Financial Planning Strategies Tips Business for additional insights and resources to bolster your financial planning efforts.